Whether it will be in M&A deepens fortress-Hollande

Takeovers of French companies had become even less desirable. In order to avoid hostile takeovers and limit plant closings, the French National Assembly gave employees a bigger say over bids. Companies attempts to find a suitable buyer before shuttering a plant with more than 50 workers.

Thibaut De Smedt a partner at Bryan, Garnier & Co which handles French corporate-finance transactions said that “It projects an image of protectionism in France, and that’s not how we’re going to fix our problems. In the M&A world, the image of France viewed from outside is deplorable, and this law is adding extra complexity.”

Foreign companies have spent USD 14.8 billion on French targets this year, putting 2013 on track to be the weakest for such deals in at least a decade, according to data compiled by Bloomberg. The new rules may further dissuade potential buyers. France hasn’t seen a major hostile takeover since Mittal Steel Co. bought Arcelor SA in 2006 in a transaction then valued at about USD 36 billion.

Potential predators were at bay. French companies remain the world’s most acquisitive.

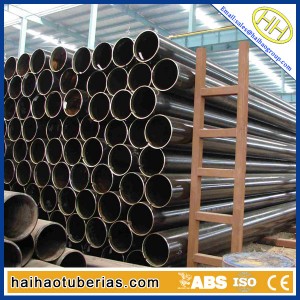

Hebei Haihao Group

Hebei Haihao Group